The Single Strategy To Use For Final Expense In Toccoa Ga

Table of ContentsThe Only Guide to Final Expense In Toccoa GaNot known Facts About Affordable Care Act Aca In Toccoa Ga5 Easy Facts About Life Insurance In Toccoa Ga ShownThe 3-Minute Rule for Life Insurance In Toccoa Ga

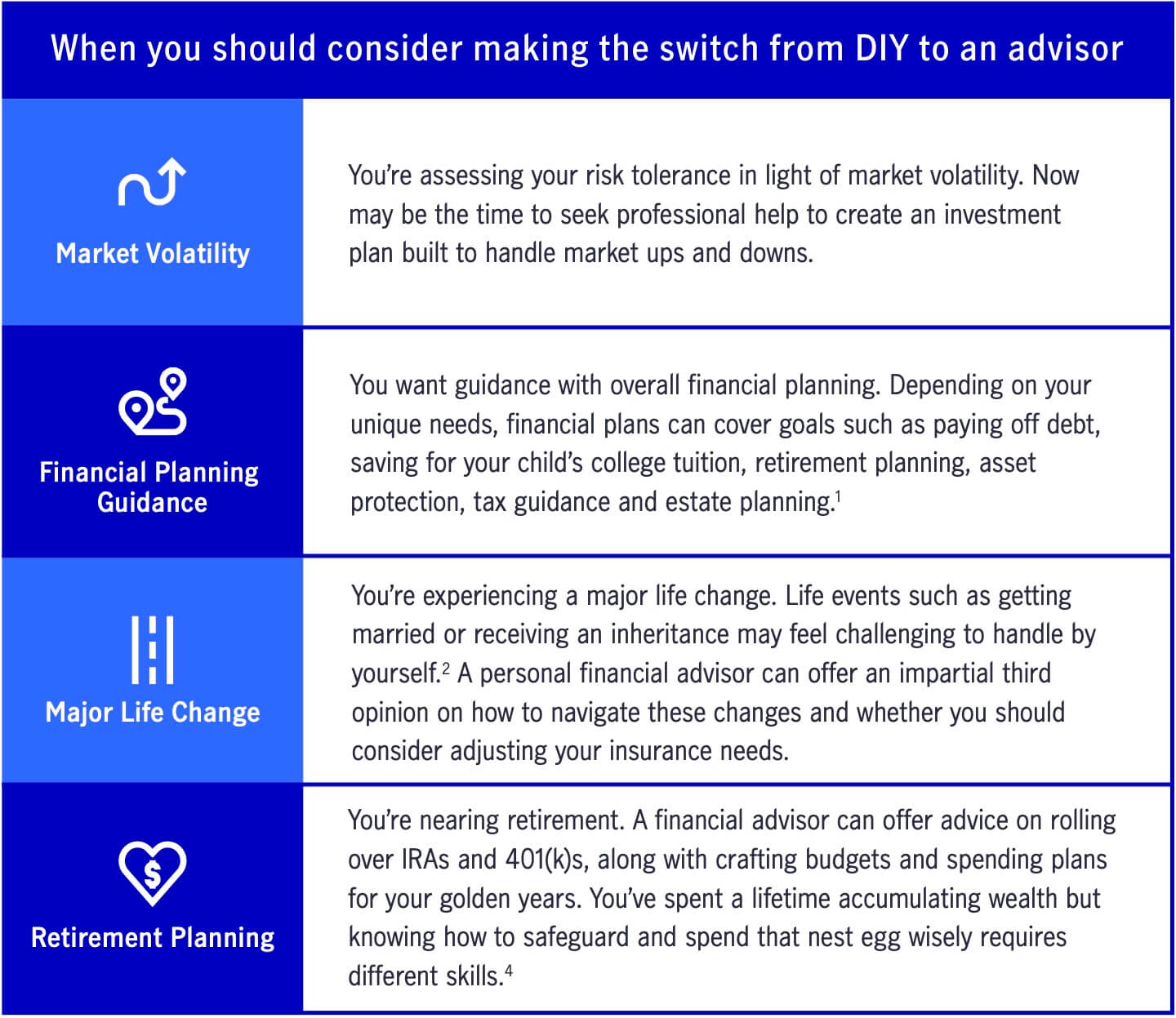

A financial advisor can additionally aid you decide just how ideal to attain objectives like conserving for your kid's college education or repaying your financial debt. Although financial experts are not as fluent in tax obligation legislation as an accountant may be, they can provide some assistance in the tax obligation preparation process.Some financial consultants use estate planning services to their clients. They may be learnt estate planning, or they might wish to function with your estate lawyer to answer inquiries regarding life insurance policy, trusts and what should be done with your financial investments after you die. It's important for monetary advisors to remain up to day with the market, economic problems and advisory finest practices.

To sell financial investment products, consultants have to pass the relevant Financial Market Regulatory Authority-administered examinations such as the SIE or Collection 6 exams to acquire their certification. Advisors who want to market annuities or other insurance policy items must have a state insurance coverage certificate in the state in which they intend to sell them.

:max_bytes(150000):strip_icc()/what-will-a-good-financial-planner-do-for-me-2388442_color2-566eaab6a87b463d951130f508b5aa3e.png)

The Best Strategy To Use For Health Insurance In Toccoa Ga

Let's state you have $5 million in properties to manage. You employ a consultant who bills you 0. 50% of AUM per year to benefit you. This suggests that the consultant will certainly receive $25,000 a year in charges for managing your investments. Due to the normal fee framework, many experts will not function with clients that have under $1 million in assets to be taken care of.

Financiers with smaller profiles might look for out a monetary advisor that bills a per hour fee as opposed to a percent of AUM. Hourly costs for experts normally run between $200 and $400 an hour. The even more facility your economic situation is, the more time your expert will have to dedicate to managing your possessions, making it a lot more costly.

Advisors are experienced experts that can assist you create a prepare for financial success and implement it. You may likewise consider connecting to an expert if your individual monetary conditions have just recently ended up being much more challenging. This might indicate acquiring a residence, obtaining wedded, having kids or getting a big inheritance.

The Ultimate Guide To Commercial Insurance In Toccoa Ga

Before you meet with the consultant for a first examination, consider what services are most essential to you. You'll desire to seek out a consultant who has experience with the solutions you want.

What business were you in prior to you got right into monetary recommending? Will I be working with you straight or with an associate expert? You might additionally desire to look at some sample economic strategies from the expert.

If all the examples you're supplied are the exact same or comparable, it may be an indicator that this expert does not effectively customize their advice for every client. There are three main kinds of economic encouraging professionals: Certified Monetary Organizer experts, Chartered Financial Experts and Personal Financial Specialists - https://community.simplilearn.com/members/jim-thomas_1.5310659/#about. The Certified Financial Coordinator specialist (CFP specialist) accreditation suggests that an expert has satisfied a specialist and ethical requirement set by the CFP Board

Things about Health Insurance In Toccoa Ga

When selecting a monetary expert, think about a person with an expert credential like a CFP or CFA - https://community.simplilearn.com/members/jim-thomas_1.5310659/#about. You might likewise think about an advisor who has experience in the services that are most important to you

These advisors are typically riddled with conflicts of passion they're extra salesmen go now than experts. That's why it's important that you have a consultant who works only in your ideal passion. If you're seeking an expert that can really provide actual worth to you, it's crucial to research a variety of possible choices, not simply select the very first name that promotes to you.

Currently, lots of consultants need to act in your "benefit," yet what that involves can be practically void, except in one of the most egregious instances. You'll need to locate a genuine fiduciary. "The first examination for a good economic consultant is if they are helping you, as your supporter," says Ed Slott, certified public accountant and founder of "That's what a fiduciary is, but everybody claims that, so you'll need other indications than the expert's say-so or perhaps their credentials." Slott recommends that consumers seek to see whether consultants buy their continuous education and learning around tax planning for retirement cost savings such as 401(k) and individual retirement account accounts.

"They need to confirm it to you by revealing they have taken major continuous training in retirement tax obligation and estate planning," he claims. "You must not invest with any type of consultant who does not invest in their education and learning.